Fixing college fee collection with virtual accounts

If you thought fee collection challenges were just about delays or missed payments, think again.

For many colleges in India, especially those offering high-ticket courses like MBAs or medical degrees, the very method of collecting fees is broken.

It isn’t just about chasing payments. It’s about making it possible for parents and students to pay large sums smoothly, securely, and with complete transparency.

Let’s unpack why traditional payment methods fail — and how virtual accounts fix it.

High-value courses, higher payment hurdles

For a typical engineering or undergraduate course, semester fees might range between ₹50,000 to ₹1,50,000.

But consider these:

- MBA programs in India range between ₹5 lakh to ₹25 lakh.

- MBBS fees can soar up to ₹50 lakh or more.

These aren’t everyday transactions. And unfortunately, everyday payment systems aren’t built to handle them.

Why traditional methods don’t work

1. UPI: Capped at ₹1 lakh per day

Most students or parents can’t use UPI to pay their full semester fees.

2. Credit Cards: Limits typically ₹2–₹4 lakh

Not just insufficient — but also incurs hefty processing charges of 1.5 - 2%.

3. Net Banking: Default limit ₹1–₹2 lakh

Even with increased limits, it still requires manual setup, approval, and trust.

What remains are three common fallback options:

- Cheques

- Demand Drafts (DDs)

- Bank Transfers

All three are clunky, outdated, and prone to error.

The offline burden: Cheques and DDs

Cheques and DDs may solve the high-ticket problem, but they create a logistical nightmare:

- Manual deposit at bank branches

- Risk of bounced cheques

- Endless follow-ups for payment status

- Post-dated cheques (PDCs) require tracking and storage

For finance teams, this isn’t sustainable. And for students, it’s frustrating.

The illusion of convenience: Bank transfers

Bank transfers seem like a digital solution. But here’s the real picture:

Colleges often share a single account number for all incoming payments.

This means :

- Students and vendors are sending money to the same account

- Finance teams now play detective: “Who paid what, and when?”

- Every transfer becomes a reconciliation headache

- Suspense accounts build up with unidentified payments

Worse still, the finance team must generate and issue manual receipts once payments are identified.

This isn’t digitization. It’s just digitally disguised chaos.

Virtual accounts: The game changer

Here’s where virtual accounts truly shine.

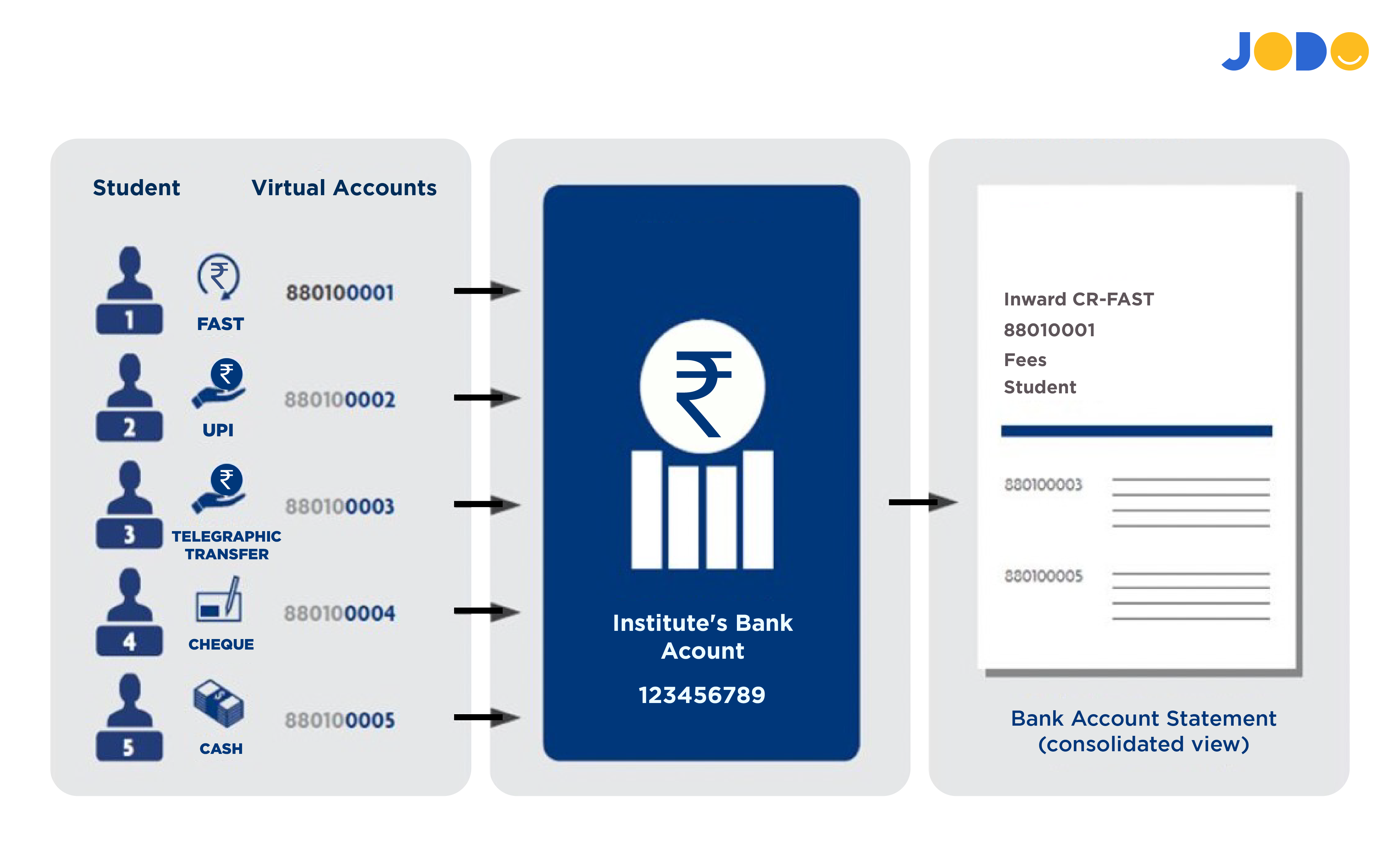

Instead of one shared account, each student gets a unique virtual account number.

What does this fix:

- No ambiguity – Each payment is auto-mapped to a student

- No suspense – Finance teams see who paid, when, and how much — instantly

- No reconciliation – The system tracks and tags payments automatically

- Auto-generated receipts – Students and parents get immediate confirmations

Think of it as giving every student their own fee collection lane — no more traffic jams.

Used by leading colleges across India

Jodo Virtual Accounts are trusted by hundreds of institutions — including top MBA colleges and medical universities.

The bottom line

When colleges adopt virtual accounts, they’re not just upgrading their fee collection system — they’re upgrading the experience for everyone involved.

No more guesswork. No more stress. Just clear, efficient, and transparent payments.

If your college is still collecting high-value fees through traditional methods, it’s time to reconsider.

Book a quick 15-minute demo and see how virtual accounts can transform your institution’s fee collections.

For more insights into how Jodo is revolutionizing fee collection, connect with our Co-founder Atulya Bhat on LinkedIn.